Why MEDDIC Fails in Real Deals — And How Action-Connected Intelligence Fixes It

MEDDIC has been around since the 1990s, developed at PTC during their hypergrowth phase. The framework is solid—Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion. Cover these six elements and you'll qualify deals more accurately than most competitors.

So why do companies spend tens of thousands on MEDDIC training, add all the CRM fields, and still have forecast accuracy problems six months later?

Because knowing MEDDIC and using MEDDIC are completely different skills. And almost every implementation we've seen focuses on the knowing part while hoping the using part takes care of itself.

The MEDDIC Promise

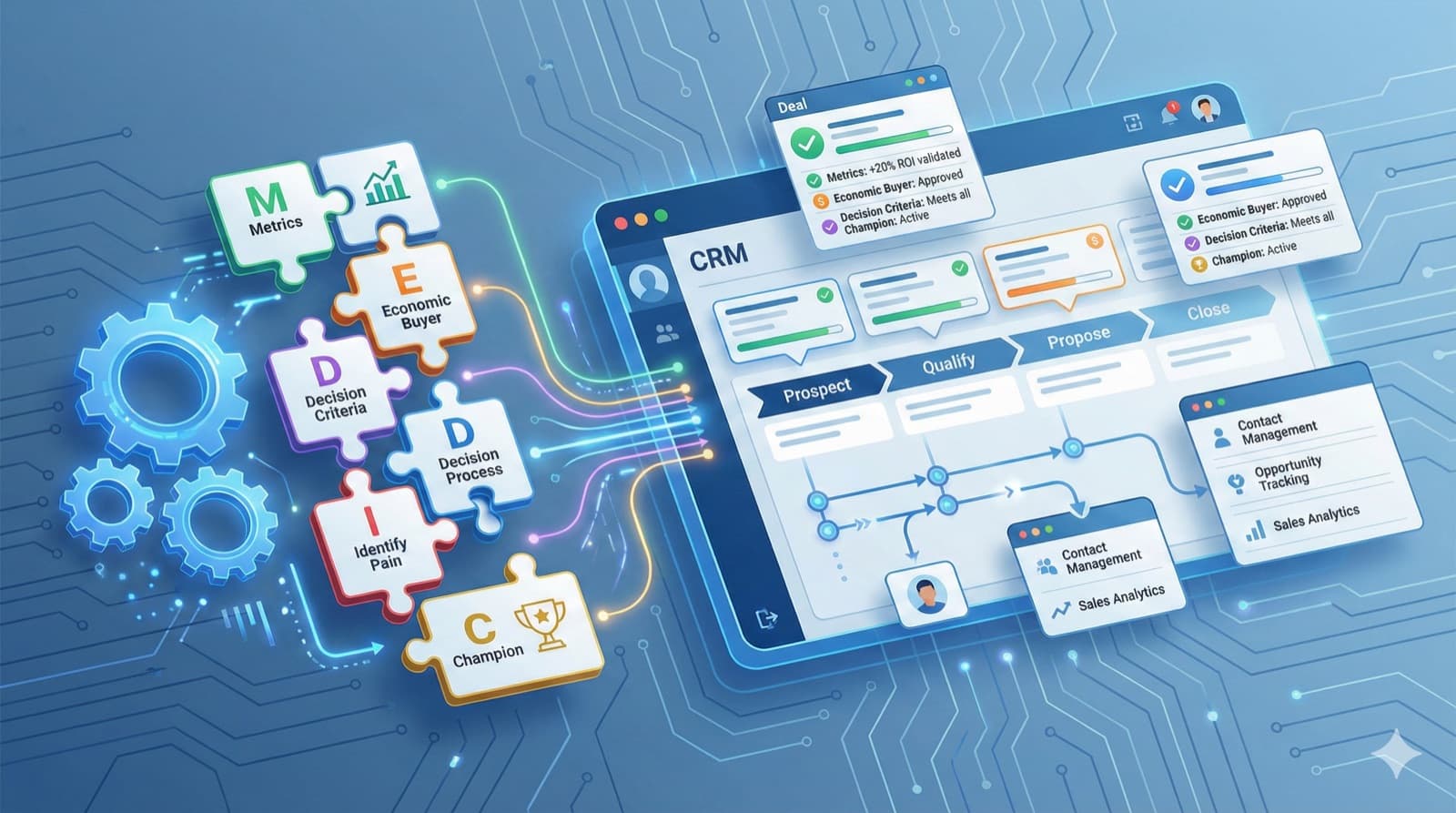

For the uninitiated, MEDDIC stands for:

- Metrics: The quantifiable results the customer wants

- Economic Buyer: The person who can approve the purchase

- Decision Criteria: What the customer will evaluate

- Decision Process: How the purchase decision will be made

- Identify Pain: The problems driving the purchase

- Champion: Your internal advocate at the customer

It's an elegant framework. When applied correctly, MEDDIC helps reps:

- Qualify opportunities more accurately

- Navigate complex deals with multiple stakeholders

- Build compelling business cases

- Forecast with confidence

The problem isn't the framework. It's the execution.

What Actually Happens (Be Honest With Yourself)

If you've implemented MEDDIC, this probably sounds familiar:

In Training (Week 1)

- 4-hour workshop on MEDDIC fundamentals

- Role plays and exercises

- Everyone leaves energized

- "This will transform our sales process!"

In the CRM (Week 2+)

- MEDDIC fields added to opportunity records

- Managers can "see" MEDDIC status

- Dashboard tracks completion rates

- Looks great on paper

In Reality (Every Day)

- Rep is on a discovery call

- Customer goes off-script with an unexpected question

- Rep forgets to ask about Economic Buyer

- After the call, rep back-fills CRM from memory

- Guesses at Decision Process based on job titles

- Champion field filled with whoever they're talking to

In Forecast Reviews (End of Quarter)

- Manager asks about MEDDIC status

- Rep reads the CRM fields they entered

- No one knows if it's accurate

- Deal slips because Decision Process was wrong

- Pipeline surprised by unknown stakeholder

This is the MEDDIC reality at most companies. The framework exists. The training happened. The CRM has the fields. But it's not actually being applied to deals.

Why This Happens (It's Not Your Reps' Fault)

Five structural problems make methodology execution hard. And blaming reps for "not following the process" misses the point—the process itself is designed for training rooms, not live customer conversations.

1. Training and Selling Require Different Brain States

Research on memory and skill transfer (the "forgetting curve" studies, though the specific numbers get misquoted constantly) points to a simple truth: learning something and applying it under pressure are different cognitive tasks. Reps learn MEDDIC concepts in a classroom setting with time to think. They apply them in conversations where they're simultaneously listening, processing, responding, and managing the relationship.

It's not that they forgot. It's that retrieval under pressure is genuinely harder than retrieval in a calm environment.

2. Conversations Don't Follow Frameworks

Real sales conversations are messy:

- Customers don't answer questions in order

- Discussions jump between topics

- Objections appear unexpectedly

- Time pressure limits what you can cover

MEDDIC is a checklist. Conversations are organic. Reps focus on the conversation and forget the checklist.

3. Back-Filling Creates Fiction

When reps update CRM after calls:

- Memory is imperfect

- Bias toward optimism

- Pressure to show progress

- Fields get filled, but accuracy suffers

"Zombie deals" emerge—opportunities that look healthy in the system but are actually dead or stalled. The MEDDIC data is fiction.

4. Enforcement Is Reactive

Managers catch MEDDIC gaps in:

- Weekly pipeline reviews

- Monthly forecast calls

- Quarterly business reviews

By then, it's too late. The discovery call already happened. The questions weren't asked. The information doesn't exist.

5. Methodology Isn't Contextual

Generic MEDDIC training doesn't address:

- What does "Economic Buyer" mean for your specific sale?

- What are typical Decision Criteria for your product?

- What Pain should you be uncovering for each persona?

- Who is a real Champion vs. a friendly contact?

Every product and market is different. Cookie-cutter MEDDIC doesn't translate.

The Pattern in Failing Deals

When we analyze deals that were lost or that significantly slipped, the same MEDDIC failures appear:

1. Champion Confusion (35% of failures)

- Rep thought they had a Champion

- Contact was actually just a User or Evaluator

- No one was actively selling internally

- Deal stalls at "no decision"

Root cause: Reps don't know how to identify and test a real Champion.

2. Missing Economic Buyer (30% of failures)

- Rep sold to technical evaluators

- Never got to budget holder

- Proposal perfect, no authority to approve

- Competitive loss to incumbent

Root cause: Reps avoid asking "who controls the budget?" because it feels awkward.

3. Unknown Decision Process (25% of failures)

- Rep assumed single decision maker

- Actually requires procurement, legal, security

- Timeline suddenly extended by 3 months

- Forecast miss, deal pushed

Root cause: Reps ask "what's your timeline?" but not "what's your process?"

4. Metrics Not Quantified (20% of failures)

- Business case was qualitative ("save time")

- No hard numbers to justify investment

- CFO asks for ROI, can't provide it

- Lost on price to cheaper competitor

Root cause: Reps don't dig for specific, measurable outcomes.

The Shift to Action-Connected Intelligence

The solution isn't more training or stricter CRM enforcement. It's embedding methodology into the actual workflow of selling.

We call this action-connected intelligence: connecting what reps need to know (knowledge) with how they should sell (methodology) in the context of each specific deal.

What Action-Connected Intelligence Looks Like

Before the call: Instead of reviewing a MEDDIC checklist, the rep sees:

- "You haven't identified the Economic Buyer for this account. Here are questions to uncover this in your discovery."

- "Based on similar deals, legal review typically adds 3-4 weeks. Ask about their procurement process."

During the call: Instead of trying to remember methodology while listening:

- Live prompts suggest follow-up questions based on what's been discussed

- Objection handling surfaces relevant talk tracks

- Missing MEDDIC elements flagged for natural conversation integration

After the call: Instead of back-filling CRM from memory:

- Key information auto-captured and structured

- Gaps highlighted with specific follow-up actions

- Deal scored against methodology criteria

- Next steps recommended based on what's missing

The Technical Implementation

Making methodology action-connected requires connecting three systems:

1. Knowledge Layer

- What does MEDDIC mean for YOUR product?

- Who is typically the Economic Buyer for each segment?

- What are common Decision Criteria by industry?

- What Pain points drive purchases for each persona?

2. Deal Context

- What information has already been captured?

- What questions have been asked?

- What stage is the deal in?

- What's at risk based on similar deals?

3. Real-Time Delivery

- Meeting prep that highlights methodology gaps

- Live Q&A that surfaces relevant frameworks

- Post-call analysis that captures key elements

- Next-step recommendations that drive completion

What Improvement Looks Like

We're hesitant to share specific case studies with precise numbers—every situation is different, and the "we improved X by 87%" claims in B2B software are often cherry-picked or hard to attribute cleanly.

What we can say from working with multiple teams: the pattern that seems to work is shifting from "remember the methodology" to "see the methodology in context."

A company we worked with had invested significantly in MEDDIC training. Six months later, their CRM data was largely fictional—reps were filling in fields to satisfy stage requirements, not because they'd actually gathered the information. Their approach to fixing it:

They embedded MEDDIC into meeting prep (surfacing "you haven't identified the Economic Buyer" before the call, not after), added prompts during calls, and auto-captured what was discussed. The exact improvement numbers varied by team, but the directional change was clear: methodology completion went up significantly, and more importantly, the data became trustworthy enough that managers started using it for actual forecasting rather than treating it as compliance theater.

The key insight wasn't the technology—it was recognizing that reps didn't need more training. They needed the methodology delivered when it was relevant, not asked about after the moment had passed.

Adapting MEDDIC to Your Reality

Generic MEDDIC doesn't work. Here's how to make it specific:

Metrics: Define Success for Your Product

- What ROI do customers typically see?

- What metrics matter to each persona?

- What benchmarks can you provide?

- What's the cost of the status quo?

Instead of: "What metrics are you trying to improve?" Ask: "Companies like yours typically see 30% reduction in X. Is that meaningful for your situation?"

Economic Buyer: Map Your Buying Centers

- Who controls budget for your price point?

- At what company size does this change?

- What's the typical approval chain?

- Who can kill the deal?

Instead of: "Who makes the final decision?" Ask: "For investments in this range, who else needs to be part of the process besides you?"

Decision Criteria: Know Your Evaluation

- What do customers always evaluate?

- What differentiates you from competitors?

- What technical requirements matter?

- What business outcomes are expected?

Instead of: "What are your decision criteria?" Ask: "When you've evaluated tools like this before, what made the difference in your decision?"

Decision Process: Understand Their Reality

- What's the typical buying process for your category?

- Where do deals usually stall?

- What stakeholders typically get involved?

- What compliance or security reviews exist?

Instead of: "What's your timeline?" Ask: "Walk me through what happens between 'we want to move forward' and 'contract signed' at your company."

Identify Pain: Go Deep on Problems

- What pains does your product solve?

- What are the consequences of inaction?

- What's the emotional component?

- What triggers urgency?

Instead of: "What challenges are you facing?" Ask: "What's happening right now that made this a priority? What's the cost if nothing changes?"

Champion: Test, Don't Assume

- What does a Champion do for your sale?

- How can you test if someone is a real Champion?

- What access do Champions provide?

- What risks do Champions take?

Instead of: "Can you help us navigate internally?" Ask: "If your leadership is skeptical, how would you make the case? What would you need from us to support that?"

Building a Living Methodology

MEDDIC isn't a one-time implementation. It's a living system that evolves with your product and market.

Monthly Reviews

- Which MEDDIC elements are consistently weak?

- Where are deals failing despite complete MEDDIC?

- What new objections or scenarios are emerging?

- What questions are working better than others?

Quarterly Calibration

- Are win/loss reasons aligning with MEDDIC gaps?

- Is the methodology adapting to market changes?

- Are competitive dynamics shifting criteria?

- Is the ideal customer profile evolving?

Continuous Improvement

- Capture what top performers do differently

- A/B test different qualification approaches

- Update talk tracks based on what's working

- Retire outdated elements

The Honest Assessment

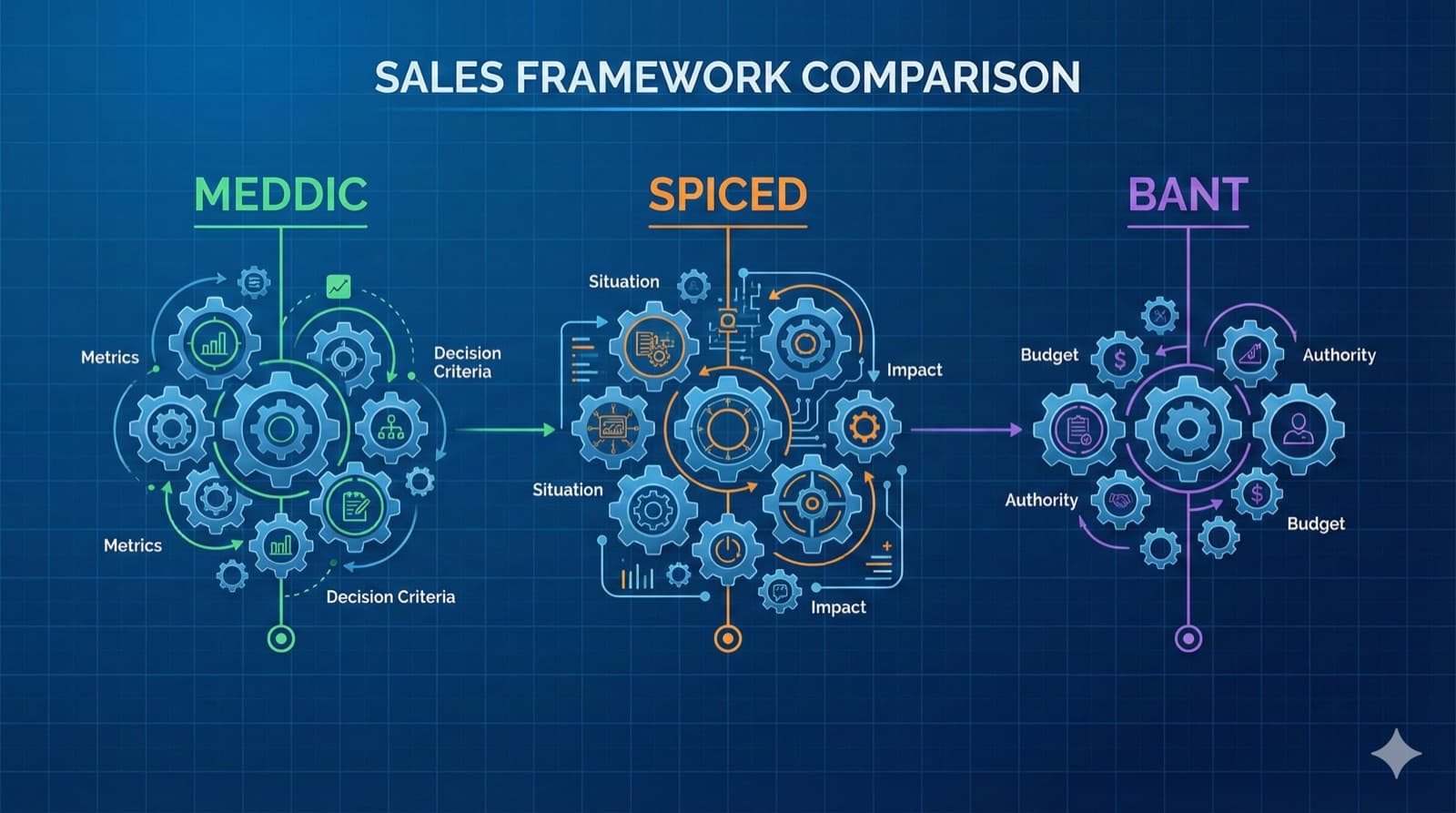

MEDDIC is a powerful framework. So are SPICED, Challenger, and half a dozen others. The framework you choose matters less than whether you can make it operational.

Most companies exist in a middle state: they've done the training, they have the CRM fields, they talk about methodology in pipeline reviews. But reps aren't actually applying it consistently in live deals. That's not a training failure—it's a systems design failure.

The shift from "methodology as training" to "methodology as workflow" isn't trivial. It requires changing how you prepare for meetings, how you capture information, and how you coach. Whether you use RevWiser or build your own system or cobble together existing tools, the principle is the same: methodology that only lives in people's heads competes with everything else they're thinking about during a call. Methodology that surfaces automatically doesn't.

We think this is the right direction for sales enablement. But we're also honest that it's early days for this approach, and what works varies by company, deal size, and sales motion.

RevWiser embeds MEDDIC and other methodologies into live deals with real-time prompts and automatic scoring. If your methodology implementation hasn't delivered, we should talk about why.

RevWiser Team

Content writer at RevWiser, focusing on go-to-market strategies and sales enablement.