Scale Your Best Operator: The Complete Guide to Sales Enablement That Actually Works

Your second AE just quit after five months of missing quota. Your third is struggling. Meanwhile, your co-founder—who's supposed to be focused on product—is still closing 60% of deals because nobody else seems to understand the product like she does.

This isn't a hiring problem. You've hired smart, experienced salespeople. The problem is that everything your founders and first reps know about selling your product lives in their heads, and there's no systematic way to transfer it.

The Performance Gap That's Costing You Growth

The numbers on rep performance are genuinely alarming. EBSTA's 2024 benchmark found that 70% of B2B reps missed quota—though we'd note that number varies significantly by how companies set quotas. What's more consistent across the research: there's typically a 2-3× gap between your top performers and your average ones.

At small scale, this is annoying. At growth scale, it's catastrophic. Here's why:

At Series B-C, you face a critical transition. What worked before—founders plus 1-2 amazing early AEs who deeply understood the product—won't scale when you need to hire 10-15 new reps quickly to hit growth targets.

The question keeping you up at night: "How do we hire people who can sell like our founders, without the founders on every call?"

Why Most Sales Enablement Approaches Fall Short

We've seen dozens of sales enablement implementations. Most fail—not because the concept is wrong, but because they treat knowledge, process, and context as separate problems that need separate solutions.

1. Knowledge Exists But Isn't Applied

Your founders and top performers deeply understand your product, positioning, and use cases. They've memorized 10-15 perfect customer stories and know exactly when to use each one. But most hired reps can't internalize and apply that knowledge in live customer conversations—they've read the docs but can't recall the right insight at the right moment.

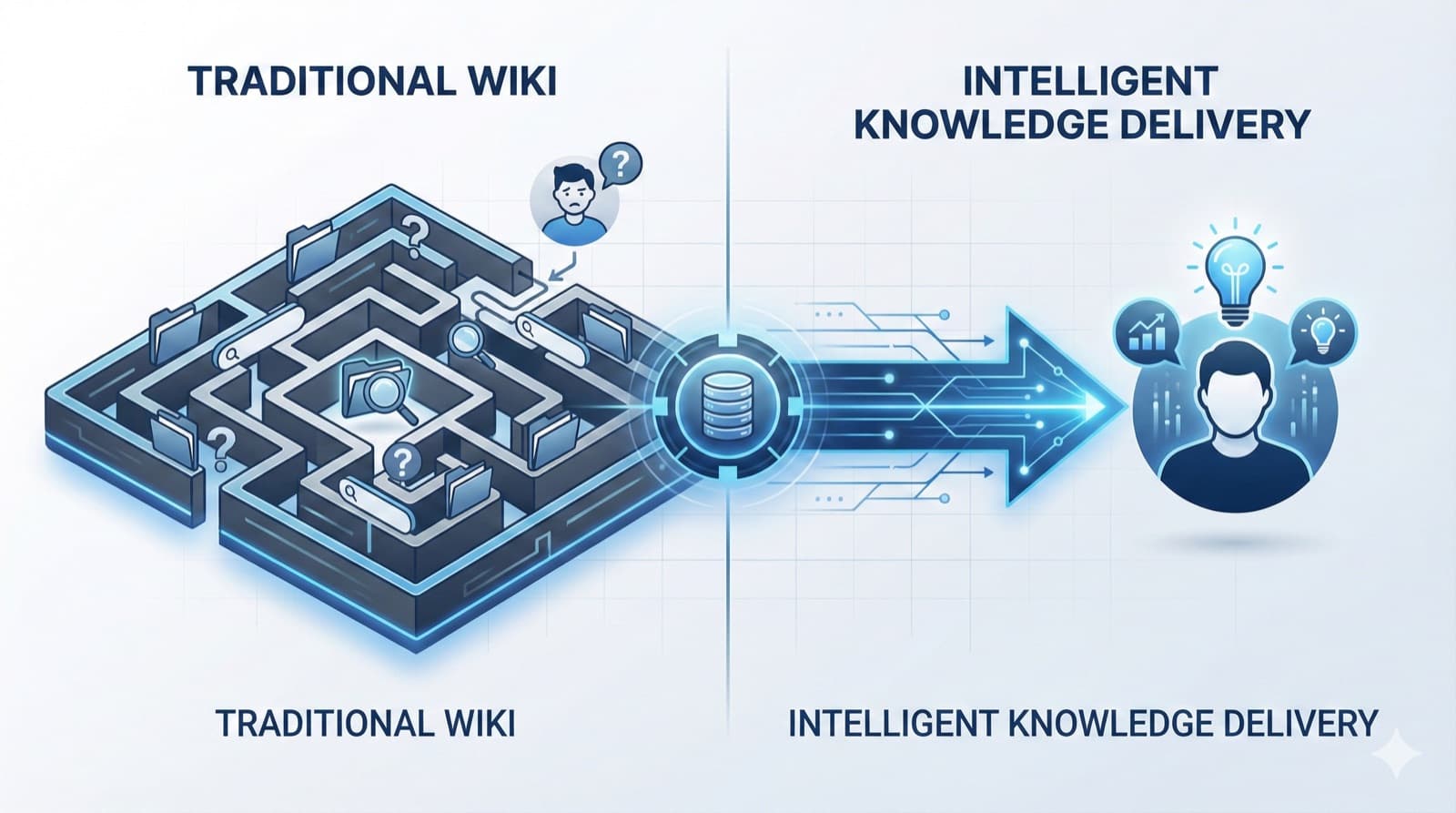

The traditional solution: Connect AI tools to Confluence or Google Drive, giving reps access to thousands of documents.

The problem: This amplifies chaos instead of creating clarity. Your Confluence has 12 versions of the same case study, half of them outdated. More data doesn't solve the problem—it makes it worse.

2. Process Is Theoretical

Sales methodologies like MEDDIC, MEDDICC, and 3 Whys are brilliant frameworks taught in training sessions. But they're rarely applied effectively to real deals with real customers.

The traditional solution: PDF playbooks stored in content libraries.

The problem: Generic MEDDIC training doesn't work because every product and ICP is different. What does "Champion" mean when you're selling a dev tool to engineering teams? What's "Decision Criteria" for a technical product with a 6-month evaluation? Your playbook should answer these specific questions, not give generic definitions.

3. Context Is Missing

Generic playbooks don't adapt to specific customer situations, product complexities, or competitive landscapes.

The traditional solution: Call recording tools that analyze what happened after the conversation ends.

The problem: Reactive analysis doesn't help reps make better decisions in the moment. They need real-time guidance based on this specific deal, with this specific customer, at this specific stage.

What Actually Separates Top Performers

After watching top reps work across different companies, a pattern emerges. It's not that they work harder or have some innate gift. They've internalized three things that work together:

Knowledge — They know the product cold, but more importantly, they know which product stories matter to which customers. They've built mental maps connecting features to outcomes to specific personas.

Process — They follow a qualification framework (whether they call it MEDDIC or not), but they've adapted it to their specific sale. They know what "Champion" actually means for their deal size and buying committee.

Context — They prepare differently for each call. They know when to push and when to listen. They adjust based on what's happening in this specific deal, not just what the playbook says.

The gap between your top performers and everyone else isn't about any single factor—it's that top performers connect all three instinctively. The question is whether you can make that systematic.

Building an Integrated System (Whether You Use RevWiser or Not)

The goal isn't more information—it's connecting the right information to the right process at the right moment. Here's what that looks like, regardless of the tools you use:

Component 1: Expert-Maintained Knowledge (Not Document Chaos)

What GTM teams actually need: The right 100 pieces of information, precisely maintained and instantly accessible.

The breakdown:

- Core Product Knowledge (15-20 pieces): Product positioning, key features with use cases, value propositions for each persona, technical differentiators

- ICP & Market Intelligence (5-8 pieces): Ideal customer profiles, buyer personas, market positioning, industry-specific messaging

- Solutions (8-12 pieces): Industry solution briefs, technical architecture, implementation approaches

- Case Studies (15-20 stories): Current customers with verified ROI, ONE authoritative version per customer, tagged by industry and use case

- Competitive Intelligence (5-10 competitors): Head-to-head positioning, feature comparisons, win strategies

Total: ~100 curated, verified, GTM-ready pieces versus 10,000 scattered documents.

The expert ownership model:

- Marketing Team → Product positioning, value props, messaging, ICP definitions

- Product Team → Feature documentation, technical specs, roadmap

- Solutions/SEs → Solution architectures, implementation guides, technical differentiators

- Sales Leadership → Playbooks, talk tracks, win patterns

- Customer Success → Case studies, ROI data, customer stories

Why this matters: When content has clear owners, it stays current. When everyone owns it (like Confluence), no one maintains it.

Example comparison:

- ❌ Traditional: Search "fintech case study" → Get 47 results, 12 versions of same customer, half outdated

- ✅ Expert-maintained: "Fintech case study for compliance use case" → Get THE one current, verified story with latest ROI

Component 2: Methodology Applied to YOUR Reality

Don't just teach MEDDIC or 3 Whys in isolation. Adapt the methodology to your specific product, market, and buyer journey.

What this looks like in practice:

Generic MEDDIC training says:

- Identify the Champion

YOUR customized playbook should say:

- When selling to engineering teams, your Champion is typically the Engineering Manager who will use the product daily and has credibility with the VP Engineering. Look for someone who has initiated similar tool evaluations before and ask: "How have you previously introduced new tools to your team?"

Generic MEDDIC training says:

- Understand Decision Criteria

YOUR customized playbook should say:

- For technical products with 6-month evaluations, Decision Criteria typically include: security compliance (SOC 2, GDPR), integration complexity, developer experience, and TCO vs. build. In the discovery call, ask: "What criteria did you use when evaluating [similar tool category] tools in the past?"

The implementation approach:

- Record what your top performers actually do in meetings, emails, and objection handling

- Document the patterns that work for YOUR product and YOUR ICP

- Connect methodology stages to specific talk tracks, questions, and resources

- Update based on wins and losses

Component 3: Real-Time Contextual Intelligence

Connect knowledge and process to every customer interaction:

Meeting Prep Intelligence:

- Analyze opportunity gaps based on YOUR methodology

- Surface relevant knowledge (case studies, objection handlers, technical specs)

- Generate prep brief that shows what's missing and what to emphasize

Live Conversation Guidance:

- Real-time suggestions based on deal stage, customer context, and your playbook

- Next question recommendations aligned with methodology

- Instant access to relevant stories, stats, and competitive positioning

Post-Meeting Intelligence:

- Automated next step identification

- Deal health scoring using YOUR criteria (not generic scoring)

- Specific action recommendations grounded in what actually works

Deal Review Intelligence:

- MEDDIC/3 Whys scoring customized to YOUR definitions

- Risk assessment based on YOUR win/loss patterns

- Clear recommendations for deal advancement

Building Your Sales Enablement System: A Practical Roadmap

Phase 1: Assess and Prioritize (Week 1)

Identify where the performance gap is costing you the most revenue:

-

Audit current knowledge:

- What do your top performers know that others don't?

- Where do new reps get stuck most often?

- Which customer questions expose knowledge gaps?

-

Document your winning process:

- How do your best reps qualify opportunities?

- What questions do they ask at each stage?

- Which methodologies do they actually follow?

-

Map your context:

- Which industries or segments are most profitable?

- What customer situations require the most support?

- Where are reps winging it instead of following a pattern?

Phase 2: Build Your Foundation (Weeks 2-4)

Start with the highest-impact areas:

Week 2: Core Product Knowledge

- Create the ONE authoritative version of each asset

- Assign clear owners (Marketing, Product, Solutions, Sales)

- Tag by persona, use case, and deal stage

Week 3: Customize Your Methodology

- Adapt MEDDIC/3 Whys/your chosen framework to YOUR reality

- Document what each element means for your product and ICP

- Connect methodology stages to specific actions and resources

Week 4: Connect to Customer Context

- Implement meeting prep workflows

- Create post-meeting action templates

- Build deal review frameworks using your criteria

Phase 3: Measure and Optimize (Ongoing)

Track the metrics that matter:

Leading Indicators:

- Time to first meaningful customer conversation (target: <2 weeks)

- Knowledge utilization rate (are reps actually using the content?)

- Methodology adherence (are they following the process?)

Lagging Indicators:

- Ramp time to first deal closed (target: 4-6 weeks, down from 3-6 months)

- Performance gap between top and average reps (target: <1.5×)

- Win rate consistency across the team

Continuous Improvement:

- Review win/loss patterns monthly

- Update playbooks based on what's working

- Refine methodology application quarterly

The Competitive Advantage: Action-Connected Intelligence

What separates effective sales enablement from content libraries?

Traditional sales enablement tools are passive repositories:

- Store content ≠ Drive actions

- Organize materials ≠ Guide what to do next

- Track downloads ≠ Connect to methodology and deals

Action-connected intelligence:

- Meeting prep → Analyzes opportunity gaps + surfaces relevant knowledge + generates prep brief

- Live conversations → Real-time guidance based on deal stage + customer context + your playbook

- Deal reviews → Methodology scoring using YOUR criteria + risk assessment + specific next actions

- Solution design → Combines product knowledge + customer needs + proven patterns

From Theory to Practice: Implementation Principles

Principle 1: Quality Over Quantity

Connecting to all your documents doesn't solve the problem—it amplifies it. Focus on creating and maintaining the essential 100 pieces that drive revenue.

Principle 2: Expert Ownership

In Confluence, nobody owns the content, so nobody maintains it. Assign clear ownership: Marketing owns positioning, Product owns features, Solutions owns architecture. When experts own their domain, knowledge stays current and trusted.

Principle 3: Methodology Customization

Your playbook should answer specific questions about YOUR product and YOUR customers, not give generic definitions. Adapt frameworks to your reality.

Principle 4: Embedded Intelligence

Don't make reps go searching for information. Deliver exactly what's needed at the exact moment it's needed, connected to the action they're taking.

Principle 5: Continuous Learning

Every interaction should improve your system. Capture what works, eliminate what doesn't, and compound your learning over time.

A Note on Our Own Experience

We built RevWiser because we experienced these problems ourselves. That said, we're honest about what we don't know: whether this approach works equally well for every sales motion is still something we're learning. Our experience is primarily with complex B2B sales in the $50K-500K ACV range. If you're selling $5K deals with two-week cycles, some of this may be overkill.

Where to Start

If you're struggling with the knowledge transfer crisis, here's how to begin—and you don't need to buy anything to start:

- Audit your knowledge: Identify the 100 pieces that actually drive revenue

- Assign ownership: Make specific people responsible for keeping each piece current

- Customize your methodology: Document what MEDDIC/3 Whys/your framework means for YOUR product

- Connect to actions: Embed intelligence in meeting prep, conversations, and deal reviews

- Measure performance: Track ramp time and performance gap reduction

The Bottom Line

The performance gap between your top performers and everyone else isn't inevitable. It exists because knowledge, process, and context are disconnected—living in different heads, different tools, different moments.

Closing that gap requires connecting all three. Whether you build that system yourself, cobble together existing tools, or use a purpose-built platform like ours, the principle is the same: stop making reps search for knowledge, remember process, and figure out context on their own.

Your founders already do this instinctively. The question is whether you can make it systematic before the next batch of new hires flames out.

RevWiser connects product knowledge, sales methodology, and deal context into guidance that surfaces when reps need it. If you're scaling from founder-led sales and struggling with ramp time, we should probably talk.

Michael Torres

Content writer at RevWiser, focusing on go-to-market strategies and sales enablement.